Stamp Duty Changes in 2025: What Homebuyers Need to Know

The UK housing market is set to experience significant changes in 2025, with updated Stamp Duty Land Tax (SDLT) rates coming into effect from April 1, 2025. These changes will impact all categories of homebuyers, including first-time buyers, additional property purchasers, and those buying their primary residences. Here’s a comprehensive overview of the changes and what they mean for you.

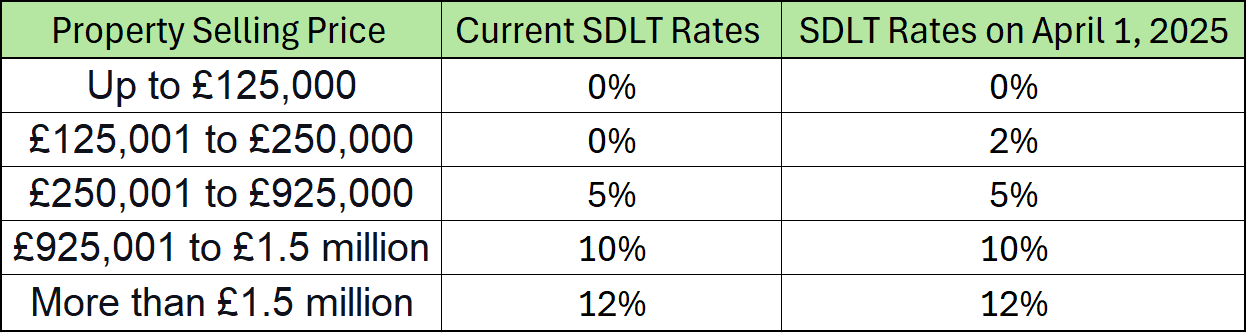

For Main Residences

In England, the stamp duty rates for primary residences are as follows (applicable to freehold properties)

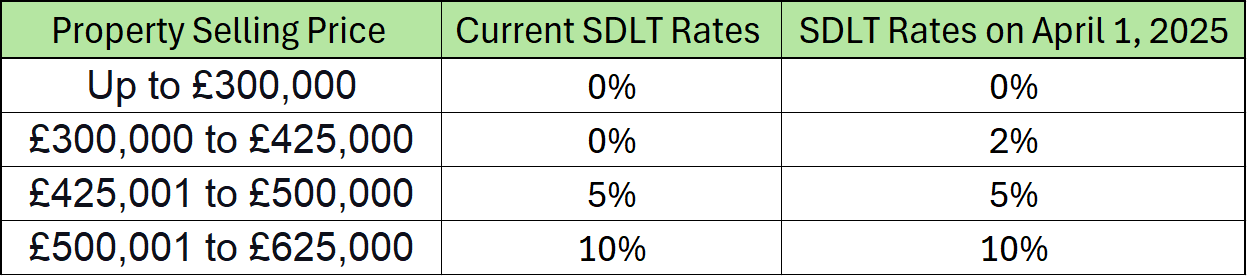

For First Time Buyers

Starting April 1, 2025, changes to stamp duty will significantly impact first-time buyers, making homeownership less affordable. The stamp duty rates for first-time buyers in England will be as follows:

Key Change:

The zero-rate threshold for first-time buyers will decrease from £425,000 to £300,000.

Properties exceeding £500,000 will no longer qualify for First-Time Buyer’s Relief.

For Additional Home Purchases

If you buy an additional property in England (e.g. a second home or a buy to let), the following thresholds apply

Summary of Key Changes

Zero-Rate Thresholds:

For main residences: Decreasing from £250,000 to £125,000.

For first-time buyers: Decreasing from £425,000 to £300,000.

First-Time Buyer’s Relief:

The maximum property price eligible for relief will decrease from £625,000 to £500,000.

Additional Properties:

SDLT rates will rise for properties between £125,001 and £250,000, increasing from 5% to 7%.

Advice for Buyers

Zero-Rate Thresholds:

For main residences: Decreasing from £250,000 to £125,000.

For first-time buyers: Decreasing from £425,000 to £300,000.

First-Time Buyer’s Relief:

The maximum property price eligible for relief will decrease from £625,000 to £500,000.

Additional Properties:

SDLT rates will rise for properties between £125,001 and £250,000, increasing from 5% to 7%.